Market Insights

Articles

Latest

View All-

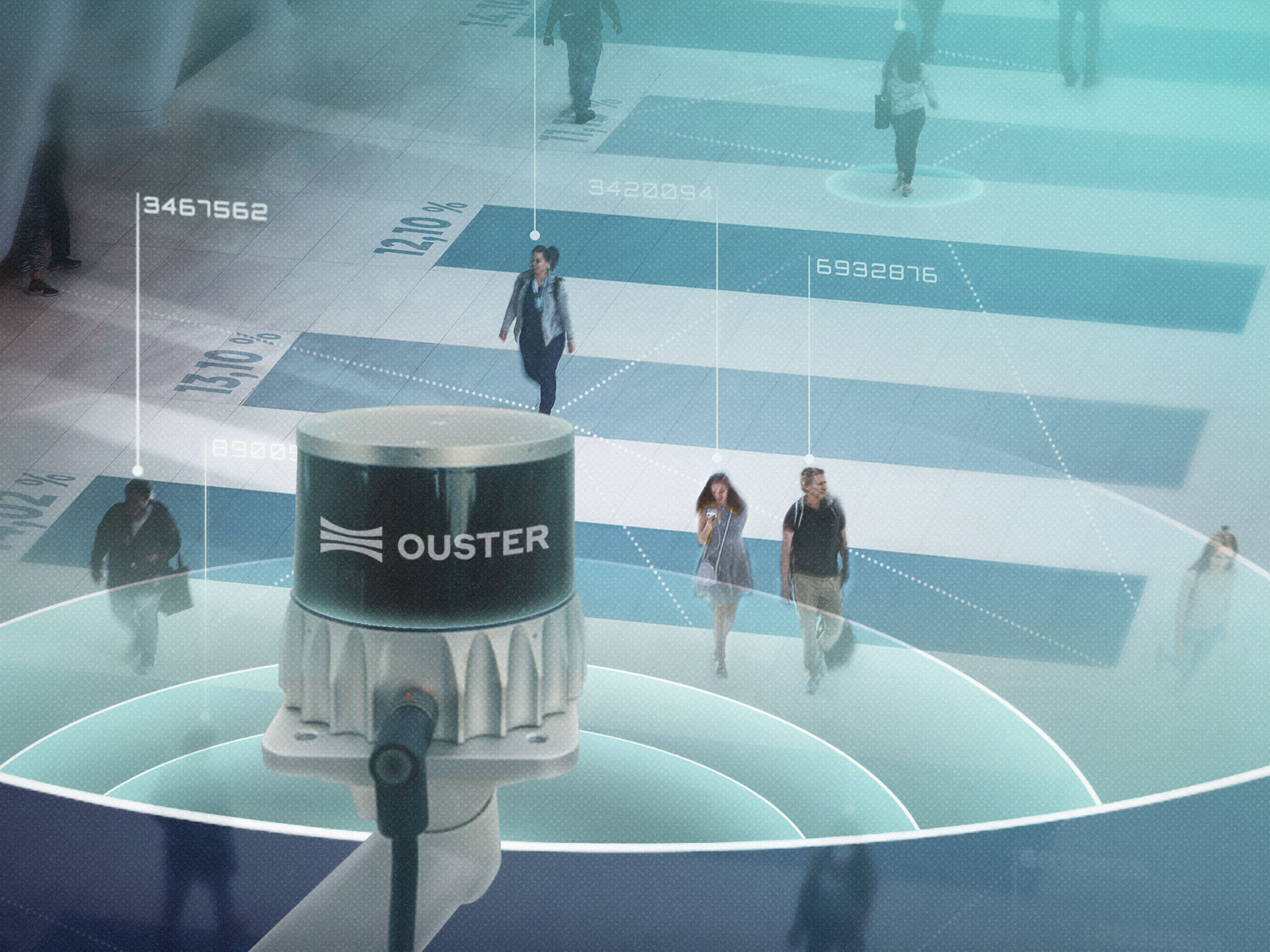

Ouster’s Lidar: Essential Innovation?

Ouster’s (NASDAQ: OUST) bet that its main product, Lidar sensors, will be an agent of change in customers’ industries is a tale of bold ambition. It’s counting on radar that uses lasers and measures distances to become the “eyes” for everything from autonomous mining rigs to privacy-conscious retail analytics via artificial intelligence. The company reported […]

-

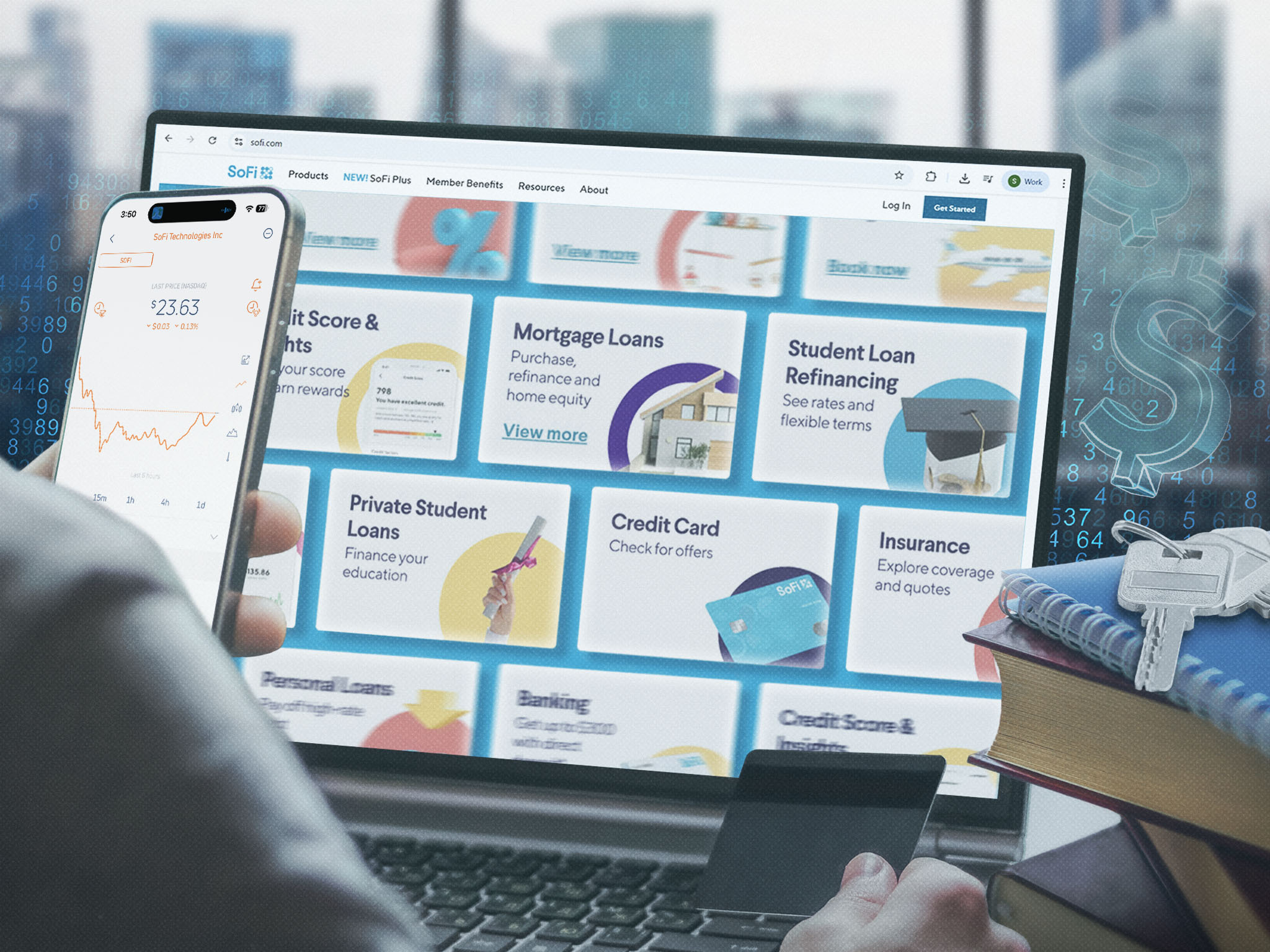

SoFi surges on diverse product offerings

SoFi (NASDAQ: SOFI), the online bank, is on a roll. Its loan volume increased in the second quarter amid the rising number of cash-strapped customers who sought more personal, student and home equity loans. SoFi’s student loans soared 35% to $1 billion in the quarter from a year earlier, and home loans skyrocketed 92% to […]

-

Are air taxis from the ‘Jetsons’ really going to fly?

Two businesses focused on personalized air transportation — Joby Aviation (NYSE: JOBY) and Blade Air Mobility — raise many questions about technology, transportation, and the practicality of modeling our future on “The Jetsons.” “The Jetsons” was a prime-time cartoon that debuted in 1962, five years after Sputnik 1 began orbiting the Earth. This cosmic knock-off […]

-

Phreesia’s subscription service, AI adoption offer potential

Since health software company Phreesia (NYSE: PHR) went public six years ago, it has almost tripled the number of customers using its platform. Digitizing medical records has been challenging. That’s because some doctor’s offices, facilities and hospitals do not invest in software that could speed up the process of receiving basic personal and health information […]

-

Many US newspapers are suffering, but not The New York Times and Wall Street Journal

Much of the U.S. newspaper industry has been left for dead amid the explosion of online news – and for good reason. But the biggest two papers are alive and well – The New York Times (NYSE:NYT) and The Wall Street Journal, which is part of Murdoch-controlled News Corp. (NASDAQ: NWSA). New York Times stock […]

-

Average Joes help fuel Blackstone’s growth

When you think of customers for Blackstone (NYSE: BX), the world’s biggest alternative investment manager, you probably think of huge institutional investors like insurance companies. But now individuals too are getting into alternative assets, which include private equity, hedge funds and real estate. They are drawn by mouth-watering returns and marketing hype from financial advisers […]