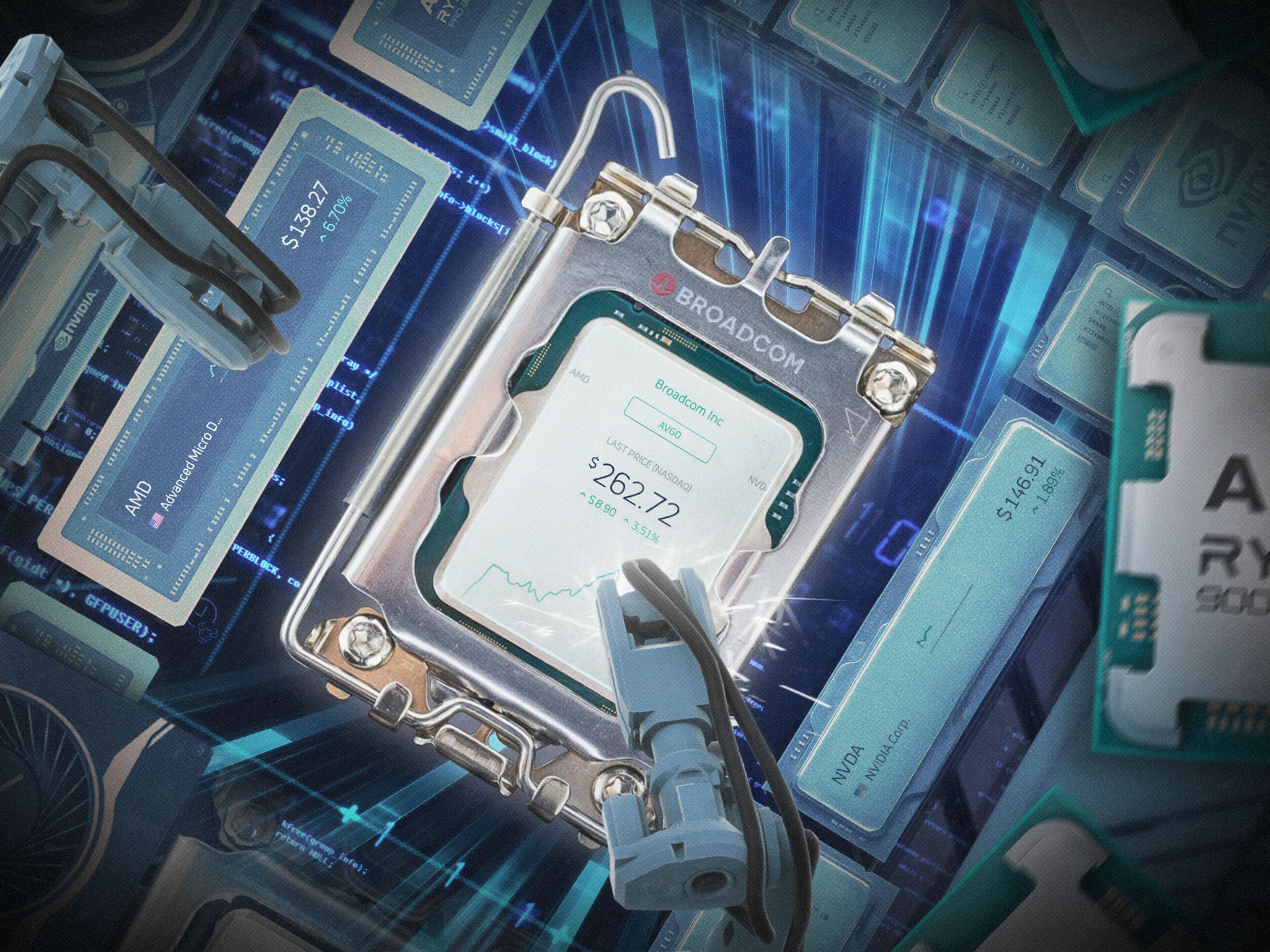

Broadcom (NASDAQ: AVGO) becomes a not-so-subtle giant building out next wave of the AI boom

Nvidia (NASDAQ: NVDA) is usually the first name that comes to mind when people think of the companies powering the physical backbone of the AI boom, with AMD (NASDAQ: AMD) as a runner-up. But there’s another contender riding the wave, and it’s already become the 7th largest US company by market capitalization: Broadcom (NASDAQ: AVGO).

The chipmaker—whose origin dates back to 1961 as the semiconductor products division of Hewlett-Packard before it was spun off into Agilent Technologies in 1999—has become a pioneer in a kind of specialized AI chip known as an XPU. Unlike the more generalized GPUs made by Nvidia such as the Hopper and Blackwell generations that are important for training (i.e. creating new AI models), Broadcom’s “custom accelerators” can be designed for specific tasks and are favored for “inference” workloads (i.e. running the existing models). They’re also known as ASICs, which stands for “application-specific integrated circuits.”

Whatever you call them, Broadcom is seeing surging interest with at least three major customers it expects to deploy million-chip clusters in 2027. CEO Hock Tan said that so-called hyperscalers are “still unwavering in their plan to invest despite the uncertain economic environment.”

“In fact, what we’ve seen recently is that they are doubling down on inference in order to monetize their platforms,” he told analysts on a conference call. “We may actually see an acceleration of XPU demand into the back half of 2026 to meet urgent demand.”

All the activity resulted in record second quarter revenue that rose 20% from the prior year period. AI revenue spiked 46% year-over-year to over $4.4 billion, and Tan said it could grow to $5.1 billion in the third quarter. Broadcom shares, meanwhile, have gained 65% over the past year—almost three times as much as Nvidia—suggesting that investors may see more scalable upside from XPUs vs. the more expensive GPUs that are already hard to get.

Which chips will prevail?

Nvidia CEO Jensen Huang, for his part, has pushed back on a lot of the excitement, suggesting earlier this month that the latest Broadcom chips would not be better than what’s already available from the company he leads. That may not be the point, however, especially with reports that the latest Nvidia GPUs are backordered for months. Companies like Google (NASDAQ: GOOGL) and Meta (NASDAQ: META) may be happy to buy as many chips as they can find—GPU or XPU—regardless of who makes them.

“This is not a zero sum game,” Daniel Newman, the CEO of tech consultancy Futurum Group, wrote in a recent post on X, adding that the market for AI chips is set to grow 30% to 40% a year and “reach the trillions” by the end of the decade. “The future will not be 100% GPU and it certainly won’t be 100% XPU.”

As Newman sees it, Nvidia chips will be prioritized for external use cases because of the company’s software and early market penetration—although they’re much more expensive. Hyperscalers, meanwhile, will turn to solutions from providers like Broadcom for internal use cases and will see cost savings that range from 50% to 70% compared to GPUs.

“The most significant reason we will see the XPU growth will be these large companies wanting to control more of their outcome and long-term destiny,” he said. “I continue to find a lot of the takes that XPUs will never make it or that Nvidia will be taken out by this accelerator business as silly baseless and oversimplified and generally incompetent viewpoint.”

There’s room for everyone, in other words, especially with insatiable demand continuing to show no signs of letting up anytime soon. When it comes to the question of which kind of AI chip will pull ahead—with good old-fashioned CPUs also in the mix, and even “neural processing units” called NPUs—the answer, for now, seems to be all of them.