Hims & Hers (NYSE: HIMS) hits the skids, and more trouble may come

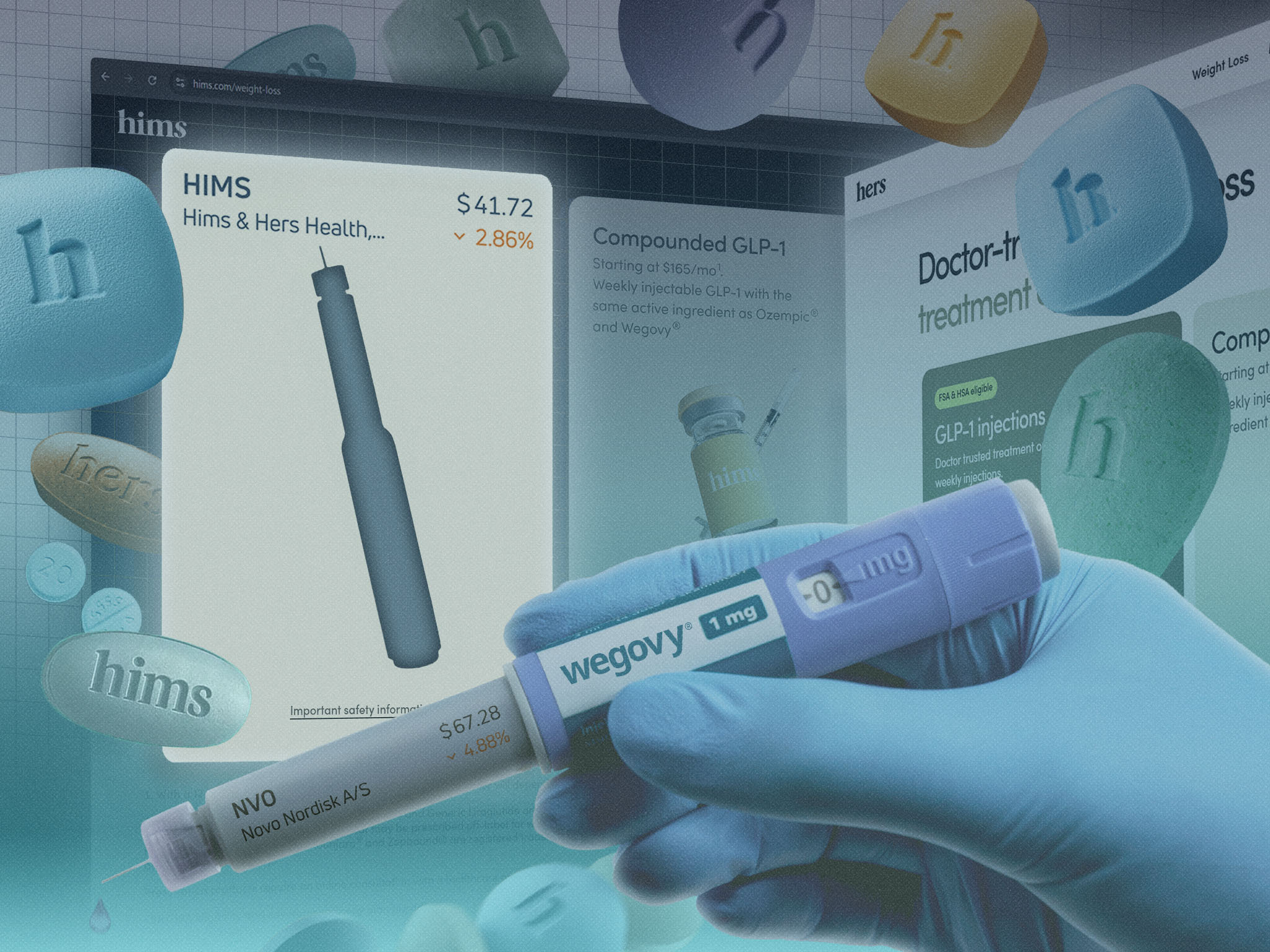

Hims & Hers (NYSE: HIMS) stock has tanked about 35% this week, after Novo Nordisk (NYSE: NVO) terminated its partnership with the former telehealth darling.

Less than two months ago, the Danish drug titan agreed to sell its weight-loss treatment Wegovy through Hims & Hers. But now Novo Nordisk says that Hims & Hers is selling cheap knock-off versions of the drug that put patient safety at risk.

Compounded drugs, as the knockoffs are called, are allowed under certain conditions. That includes dealing with drug shortages and personalizing dosages for patients. But Novo Nordisk claims Hims generated illegal “mass sales” of knockoffs under the guise of personalization.

“When patients are prescribed semaglutide [the active ingredient in Wegovy] treatments by their licensed healthcare professional or a telehealth provider, they are entitled to receive authentic, FDA-approved and regulated Wegovy,” said Dave Moore, an executive vice president at Novo Nordisk Inc.

Some analysts found Novo Nordisk’s action surprising, because it knew going into the agreement that Hims & Hers was selling knockoffs. But it may not have been aware of the extent, and it may have expected Hims & Hers to drop the practice.

Hims & Hers claims that Novo Nordisk pressured it to sell Wegovy whether it was an appropriate treatment or not. It also says that its compounded drugs were permissible. Hims & Hers may have thought that Novo Nordisk would accept the sales of knockoffs, and it may feel its business won’t suffer much from Novo Nordisk pulling out.

Weight-loss drugs accounted for 14% of Hims & Hers revenue last year, according to Google’s artificial intelligence.

Other areas may be in trouble

Weight-loss drugs may not be the only area where Hims & Hers is vulnerable. About 30% of Hims & Hers’ revenue comes from hair loss and sexual health treatments. Cracks are emerging in those areas too.

In April, the Food and Drug Administration issued a warning for generic hair-loss medication sold by Hims & Hers and its competitors. It said some patients have exhibited side effects, including sexual dysfunction and suicidal thoughts. The FDA also said that telehealth providers didn’t always warn patients of the side effects.

In addition, Amazon (NASDAQ: AMZN) announced in November that Prime members can obtain a fixed-price treatment program for five common maladies, including erectile dysfunction and men’s hair loss. That put the massive retailer in direct competition with Hims & Hers, which obviously isn’t good for the latter.

To be sure, the stock was on a roll from late April until the Novo Nordisk news and still stands 87% higher than it did a year ago. Hims & Hers’ revenue soared 111% in the first quarter from a year earlier, to $586 million.

Still, it’s possible that the company’s performance has peaked. We’ll get a better picture of how Hims & Hers is doing when its next earnings report comes out in August. Its full-year 2025 revenue forecast was unchanged in May, at $2.3 billion-$2.4 billion. But that was before its split with Novo Nordisk. So the numbers may worsen.