Ouster’s (NASDAQ: OUST) bet that its main product, Lidar sensors, will be an agent of change in customers’ industries is a tale of bold ambition.

It’s counting on radar that uses lasers and measures distances to become the “eyes” for everything from autonomous mining rigs to privacy-conscious retail analytics via artificial intelligence.

The company reported that revenue increased 30% to $35 million in the second quarter year over year. But It posted a net loss of $21 million, shrinking from $24 million a year ago.

Shareholders look pleased with the $1.5 billion market-cap company’s results. In the past month, the stock soared 165% and surged 198% during the past six months.

Ouster has differentiated itself from competitors by focusing on end markets. It’s working with the retail, industrial, infrastructure and transportation industries, not focusing just on the automotive industry. Its customers range from government entities to retailers.

In the second quarter, “the biggest vertical for us was industrial,” said CEO Angus Pacala, according to Investor’s Business Daily. That really is our bread-and-butter vertical.”

Key issues for Ouster

Yet, as Ouster’s story unfolds, questions linger:

- When will the company churn out a profit?

- Can its AI-driven tools maintain their edge in a fiercely competitive arena?

- Will its competitors start offering some of the same products at a discount?

The technology produced by Ouster is used for vehicles, airplanes, helicopters, robotics and other types of machines for mapping and is more advanced than optical cameras.

Ouster’s strength lies in its versatility, sidestepping the automotive-only trap that snares rivals like Luminar Technologies (NASDAQ: LAZR).

The company signed two multi-million dollar deals in May, including one with Komatsu, the Japanese construction equipment maker. Ouster will supply its 3D digital lidar sensors for Komatsu to develop its autonomous mining equipment offerings.

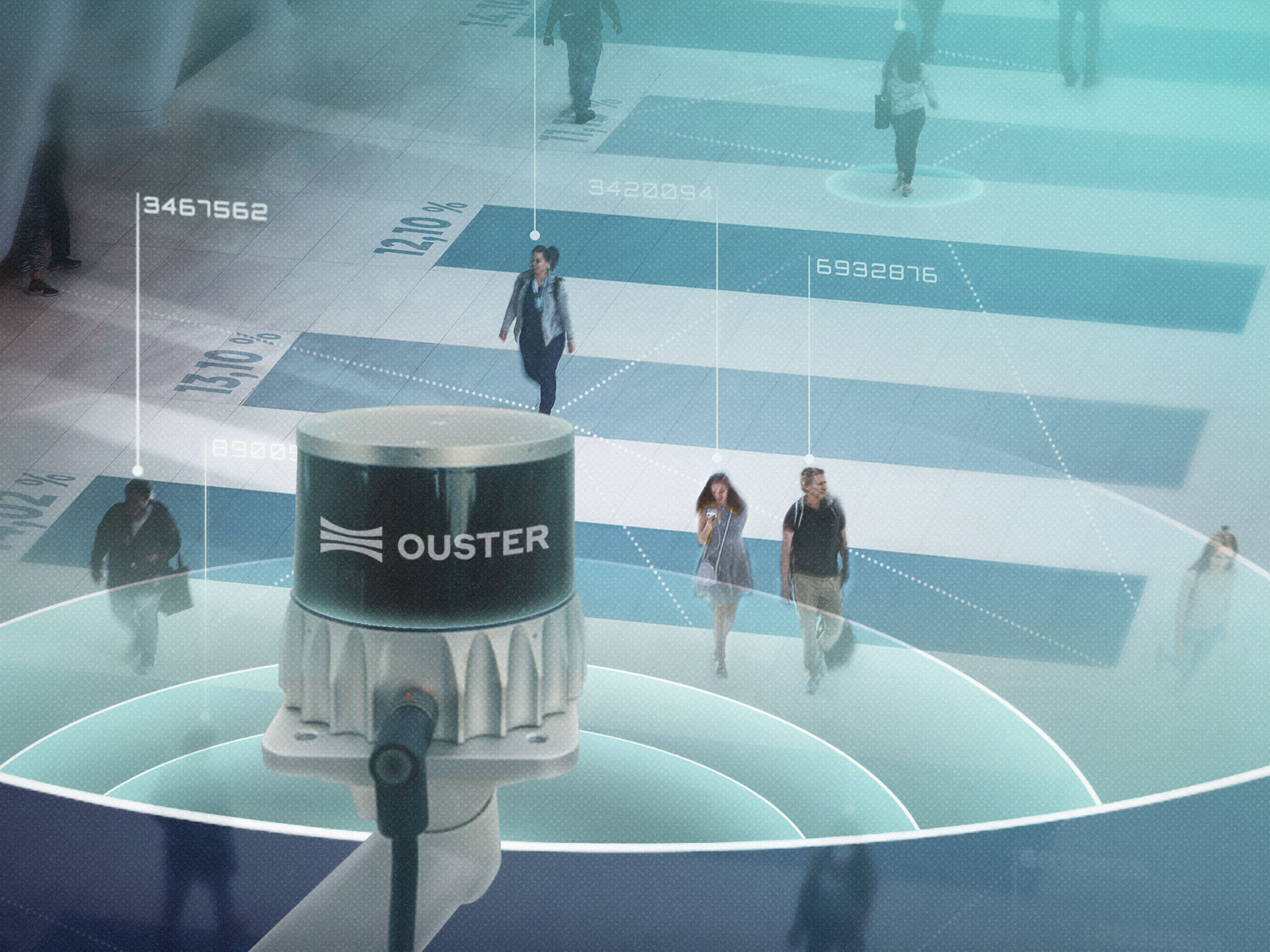

The company also has a deal with LASE PeCo, a German manufacturer of customer and traffic analytics, to use 3D digital lidar technology across Europe. LASE PeCo will deploy Ouster’s technology for counting people, mobility analytics, and perimeter and intrusion protection in public spaces and retail environments.

In June, the company said its OS1 digital lidar was vetted and approved by the U.S. Defense Department for use in unmanned aerial systems. Its tech is already being used by the federal government in agencies such as NASA, the Army, Navy, National Labs and several transportation departments.

Ouster also signed a deal with a major unnamed retailer to provide the company with shopping habit data, according to Barron’s. Retailers can use lidar without seeing images of consumers, giving them privacy.

‘Dependent’ customers

Ouster’s ability to process data quickly has resulted in customers who are “increasingly dependent on its development tools and software ecosystem,” Oppenheimer analyst Colin Rusch wrote in a research note.

Ouster has its work cut out for itself since its competitors are much larger. China’s Hesai (NASDAQ: HSAI) has a market cap of $2.97 billion.

Ouster needs to watch out for smaller competitors too, such as Luminar and Aeva Technologies, which launched its 4D LiDAR sensor that was constructed to transform smart infrastructure and security.

Another headwind for Ouster is tariffs, as the company uses Benchmark Electronics (NYSE: BHE) and Fabrinet (NYSE: FN) to manufacture its hardware at their factories in Thailand.

While Ouster needs to generate a profit soon, before its rivals make better or cheaper products, its early adoption of diversification into many markets could be the key to its success.

Comments