SoFi (NASDAQ: SOFI), the online bank, is on a roll. Its loan volume increased in the second quarter amid the rising number of cash-strapped customers who sought more personal, student and home equity loans.

SoFi’s student loans soared 35% to $1 billion in the quarter from a year earlier, and home loans skyrocketed 92% to $799 million. Personal loans all together grew a whopping 66% to $7 billion.

Investors have noticed. The stock has climbed 10% during the past month and 59% over the past six months. Payback problems haven’t been an issue.

Increasing consumer confidence could help SoFi further. The Conference Board’s consumer confidence index rose to 97.2 in July from 95.2 in June.

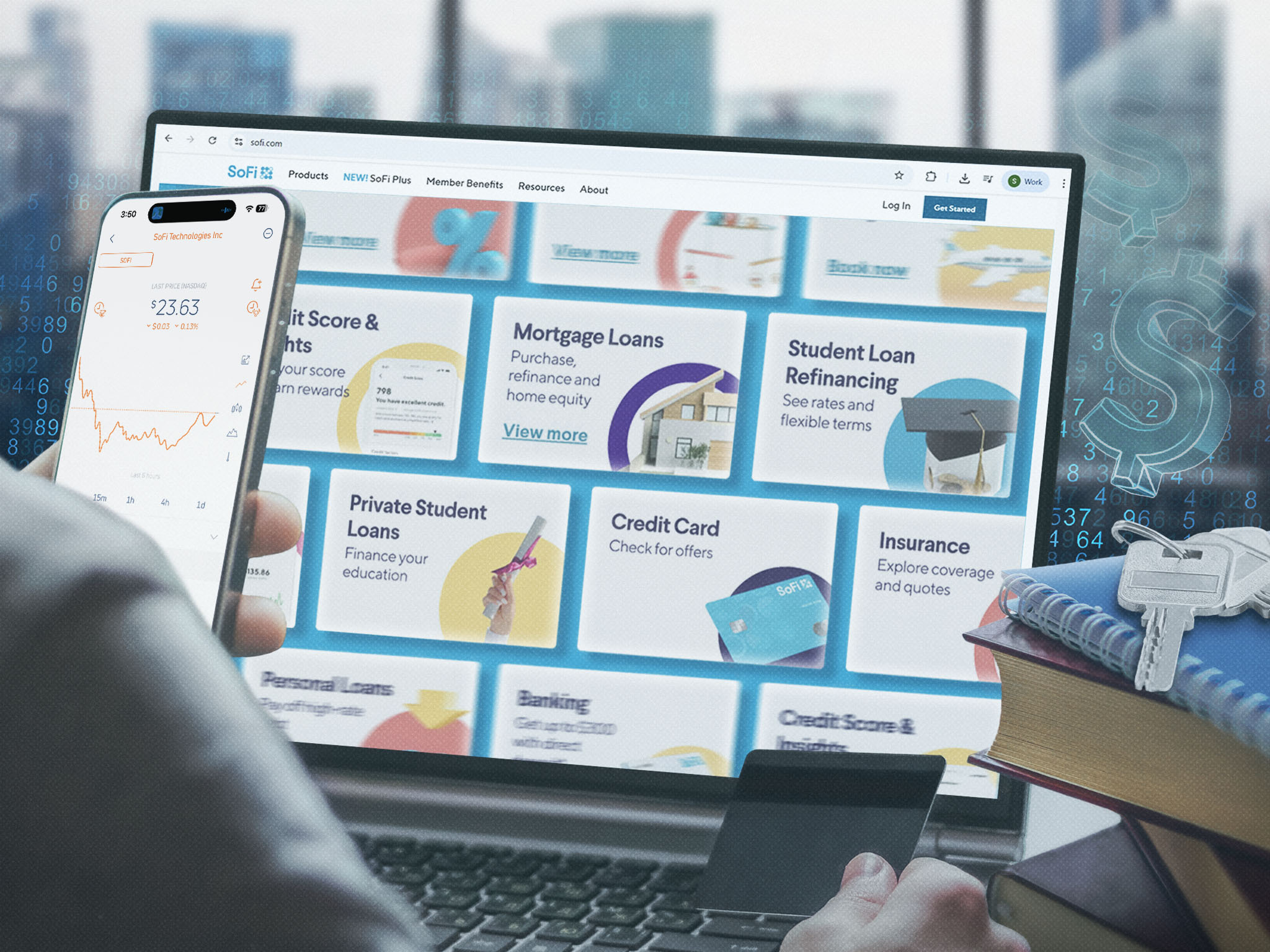

So-Fi could be a more attractive option to consumers compared to traditional banks, because it offers products such as refinancing student loans, credit card consolidation, travel and wedding loans.

‘Improving outlook’

“The growth outlook for SoFi clearly appears to be improving as the company continues to accelerate member and product growth with its diverse product roadmap,” Tim Switzer, a Keefe, Bruyette & Woods analyst, wrote in a research note.

SoFi said its loan originations rose in the second quarter due to a new flexible student loan refinancing option and a recent home-equity loan offering. It also cited a new personal loan product for prime credit card customers.

SoFi’s customer base jumped 34% in the second quarter to 850,000 individuals. The company expects the influx to continue – with an addition of 3 million for 2025 as a whole. That’s a 30% increase from last year. SoFi’s adjusted net revenue gained 44% in the second quarter from a year earlier, to $858 million.

“The Street is only beginning to appreciate the extent and speed of SoFi’s disruptive digital banking offerings,” William Blair analyst Andrew Jeffrey said in a report. “Traditional banks will not be able to compete, and will rapidly lose share to SoFi, as the company brings to bear the widest selection of savings, spending, lending, investing and advice offerings.”

SoFi also reported that its financial services revenue more than doubled in the second quarter, to $362.5 million. Net interest income surged 39%, to $193.3 million, due primarily to growth in consumer deposits.

Potential headwinds

To be sure, if economic pressures intensify, SoFi could face headwinds. With consumers already increasing their debt levels amid high interest rates, rising unemployment from further layoffs could spike delinquencies and defaults.

But for now, the numbers look good. SoFi reported its annualized charge-off rate for personal loans fell from 3.31% in the first quarter to 2.83% in the second. The on-balance-sheet 90-day delinquency rate for personal loans declined for the fifth consecutive quarter to 0.42%.

The Federal Reserve’s likely interest rate cuts might help SoFi, but ongoing inflation and job market weakness could erode repayment capacity, pressuring SoFi’s profitability.

Whether SoFi capitalizes on refinancing opportunities or faces heightened risks from defaults will depend on broader economic trends, leaving investors to weigh the risks.

Comments